You may be surprised to hear that roughly 543,000 new businesses get started each month. If you are one of them, you know that there’s a lot to do before you can call yourself an ecommerce merchant.

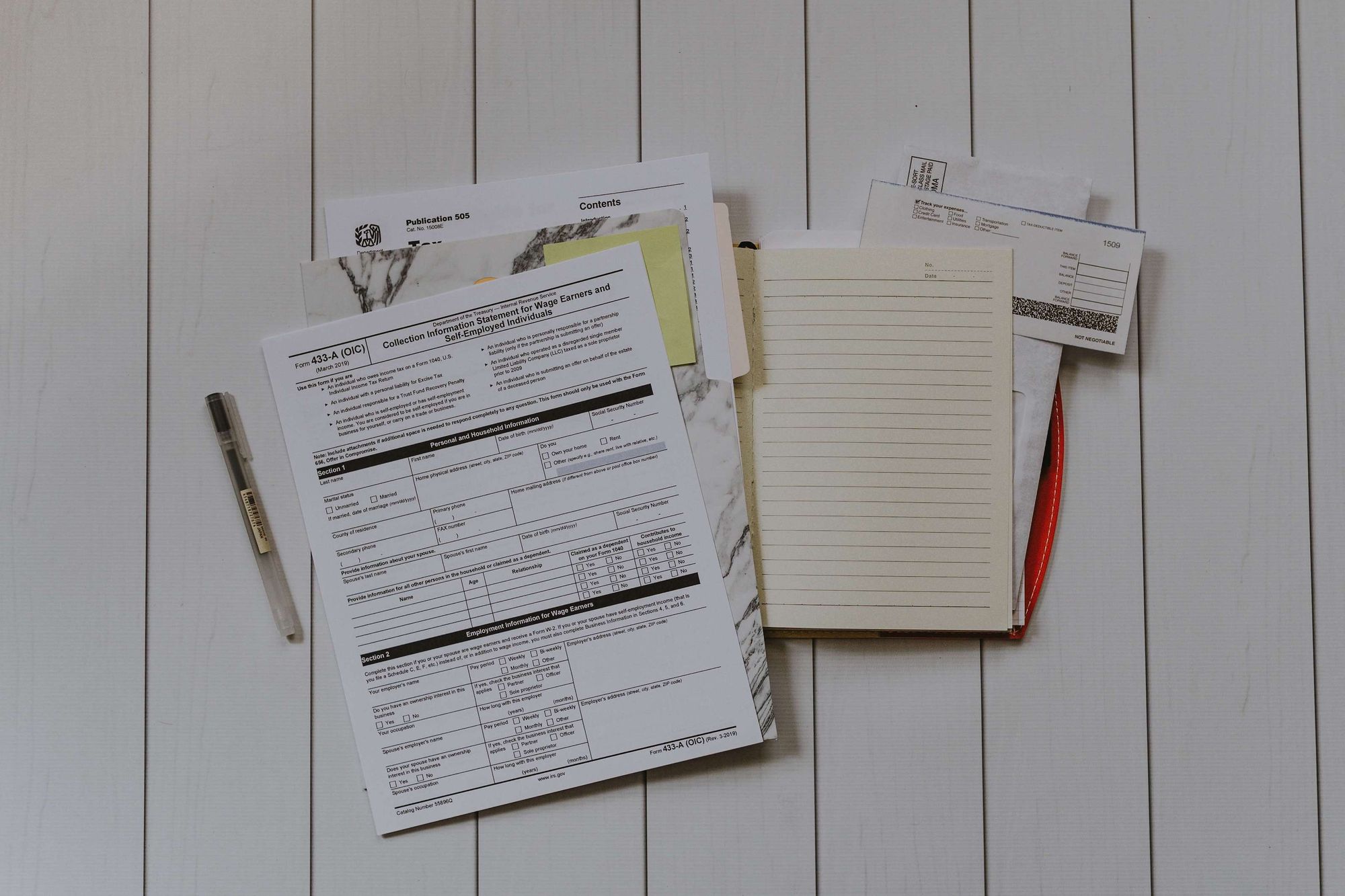

Fortunately, the multi-step process of registering your online business is easy to navigate once you map it out. On the road to legitimizing your ecommerce store, you’ll likely need to make an important pitstop at the Internal Revenue Service for an employer identification number (EIN).

Not sure if you need an EIN, or how to go about getting one? Keep reading this informative guide to find out.

What is an EIN?

You can think of your IRS-issued EIN, also known as your federal tax ID, as the business equivalent to your social security number. This nine-digit number is totally unique to your online store, and is primarily used for tax reporting purposes. On the government side, your EIN acts like an account number so the IRS can properly track the profits and losses reported on your tax returns.

EINs have no expiration date and are only ever issued to one particular business. To be eligible for one, your business must be located in the US, and you must apply using an established tax ID number (like your social security number, for example). However, the size of your company doesn’t matter—you can be employee-owned with one person on payroll or a multinational corporation who oversees thousands, and you still need only one EIN to run your business.

Why might your business need an EIN?

In general, operating with an EIN allows your business to pursue more and protects you from some financial liability. In other words, even if you aren’t legally required to obtain an EIN for your online business, you may still want to. Here are some things you can do with an EIN:

Filing Business Taxes

For starters, your business is expected to file a tax return each year. More than likely, you’ll be paying some federal taxes when you do. Having an EIN allows you to make those payments online and create tax documents like W-2s for any employees you withheld taxes for.

Creating a Better Accounting System

Having an EIN also simplifies your accounting. Let’s say you want to open a business bank account to keep your personal and business finances separate. To register the account in your LLC’s name, you’ll need an EIN. Doing so will also help build your business’ credit history in case you ever need to apply for a loan, line of credit, or business credit card. Plus, having documentation to prove you manage your business as a separate entity can protect your personal assets from business losses.

Easing Vendor Relations

For many online merchants, an EIN facilitates relationships with other vendors, wholesalers, and retailers they work with. Many of these entities will ask for an EIN before they will process payments to or from your company.

Charging Sales Tax

If you’re selling online you probably also need to charge sales tax on some of your items. Sales tax laws vary by state, but it may be worthwhile to register for an EIN for any sales tax filing you’ll need to remit.

Protecting your Identity

Having an EIN decreases the chances of your personal social security number becoming compromised. Identity theft is everywhere, and the more you give out your SSN to banks, suppliers, or tangential companies, the more you open yourself up to potential fraud.

Which business types need EINs?

Most business entities need an established EIN to file their tax returns, including co-ops, trusts, estates, nonprofits, and investment organizations. Businesses who file Excise or ABT (alcohol, tobacco, and firearms) Tax returns are also required to have a designated EIN.

As an online business, you’re more likely to fall into one of a few entities like a Sole Proprietorship, LLC, partnership, or corporation. While the latter two almost always require an EIN to pay their business taxes, there is often confusion about whether LLCs and Sole Proprietorships require one.

One quick way to know if your business needs an EIN is to ask the simple question: do you pay any W-2 employees? If so, you need an EIN to issue payroll and withhold the appropriate taxes.

But what if you’re a solo ecommerce merchant running a store all by yourself? If you pay yourself like an employee or have a self-funded pension plan (called a Keogh plan), you need an EIN to file. If not, let’s explore your options.

Does an LLC need an EIN?

Filing as a Limited Liability Company (LLC) allows you to choose how you’d like to be taxed. Single-member LLCs who are owned by an individual and elect to be treated as a corporation will need an EIN. Single-member LLCs who don’t file this way are considered a "disregarded entity,” and the IRS views them as a Sole Proprietorship come tax time.

Another easy way to remember this is that if you file a tax return for your LLC separate from your personal return, you will need an EIN to do so.

Does a Sole Proprietor need an EIN?

Let’s say you are a single-member LLC and don’t fill out the IRS forms designating your business as a corporation or an S Corporation. In the eyes of the IRS, you are considered a Sole Proprietorship and will be taxed as such.

If you’re a Sole Proprietorship doing business as an LLC with no employees, a separate EIN number is not required. In this case, you’d notify the IRS of your LLC’s business profits and losses when you file a personal tax return using your social security number. Unless you’re considered (and paid as) an employee of your LLC, no EIN is necessary to file.

How do you apply for an EIN?

The EIN application process is simple and, best of all, free! Though the IRS encourages ecommerce businesses to apply for an EIN online, they also accept applications sent via fax, through the mail, and in certain cases, by phone. One word of caution: make sure to go directly through the IRS, and beware of third-party company that charges a fee to complete your application.

What You Need to Apply

Regardless of how you apply for an EIN, you’ll need to come prepared with some basic information about your ecommerce business. At minimum, make sure you have the following on hand:

- Business name

- Business address

- Business type (LLC, Sole Proprietor, Partnership, etc.)

- Need for EIN (Starting up, Hiring Employees, Creating a Pension, Changing your business entity, etc.)

- Number of employees you expect to employ during upcoming year

- Field of business

- List of merchandise, products, or services offered

- Tax ID of owner or principal officer (person considered the “responsible party”)

EIN Online Application

Want your EIN issued the same day you apply? Use the IRS’ Internet EIN application. It only takes a few minutes to fill out your ecommerce info, validate what you entered, and issue your very own EIN.

- Visit the IRS website and click on the “Apply for an Employer ID Number (EIN)” button, which takes you to a new page.

- Read the instructions on the EIN application page, then click “Apply Online Now” to reach the EIN Assistant page.

- Click “Begin application.”

- Answer the questions as prompted, including information about your business type, reason for requesting an EIN, and personal information.

- Submit your application—your unique EIN will be issued immediately following.

- Download, save, and print your EIN.

Remember that your application must be completed in one sitting. Additionally, have all the necessary documents with you before applying—the session expires after 15 minutes of inactivity and can’t be saved.

You’ll be able to use your EIN as soon as its issued to fill out official paperwork or open a business bank account, but will need to wait two weeks before you can file a tax return online.

EIN By Fax or Mail

If you have some time to spare or prefer pen and paper to keyboard, you can print and fill out Form SS-4. Make sure to go section by section, filling out each appropriate blank of the form. Page 2 has an “If...Then” guide showing which lines must be completed based on different business entity types and situations.

If your business is located in the US, you’ll fax or mail your completed Form SS-4 to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Be sure to include a return fax number on the form—it’s how the IRS will send back your unique EIN around four business days after the date your application is received.

If you’re applying by mail, you’ll have to wait even longer. The processing time can take up to four or five weeks before an EIN is issued via mail.

EIN By Phone

Only applicants and businesses who reside outside of the US can apply for an EIN via phone at 267-941-1099. Make sure that the person calling is properly authorized and can answer questions from Form SS-4.

If you want to designate someone aside from the principle or responsible party to answer the questions for you (such as a native English speaker), simply fill in the Third Party Designee section and sign the authorization. Doing so will allow this person to receive your EIN; however, they’ll be dropped as the designee once your EIN is issued.

Your EIN will be given to you over the phone, so be sure to log it and keep it in a safe place. Hold on to Form SS-4, as you may be asked to send it to the appropriate IRS tax office.

Get to work acquiring your EIN!

Whether you’re legally required to get an EIN for your online business or simply like the advantages and protections it offers, an EIN is a smart way to legitimize your ecommerce store. Since the IRS makes it so quick and inexpensive to get one, there’s really no reason not to take advantage of this opportunity. The sooner you check it off your list, the sooner you can use your EIN to start expanding your online store.