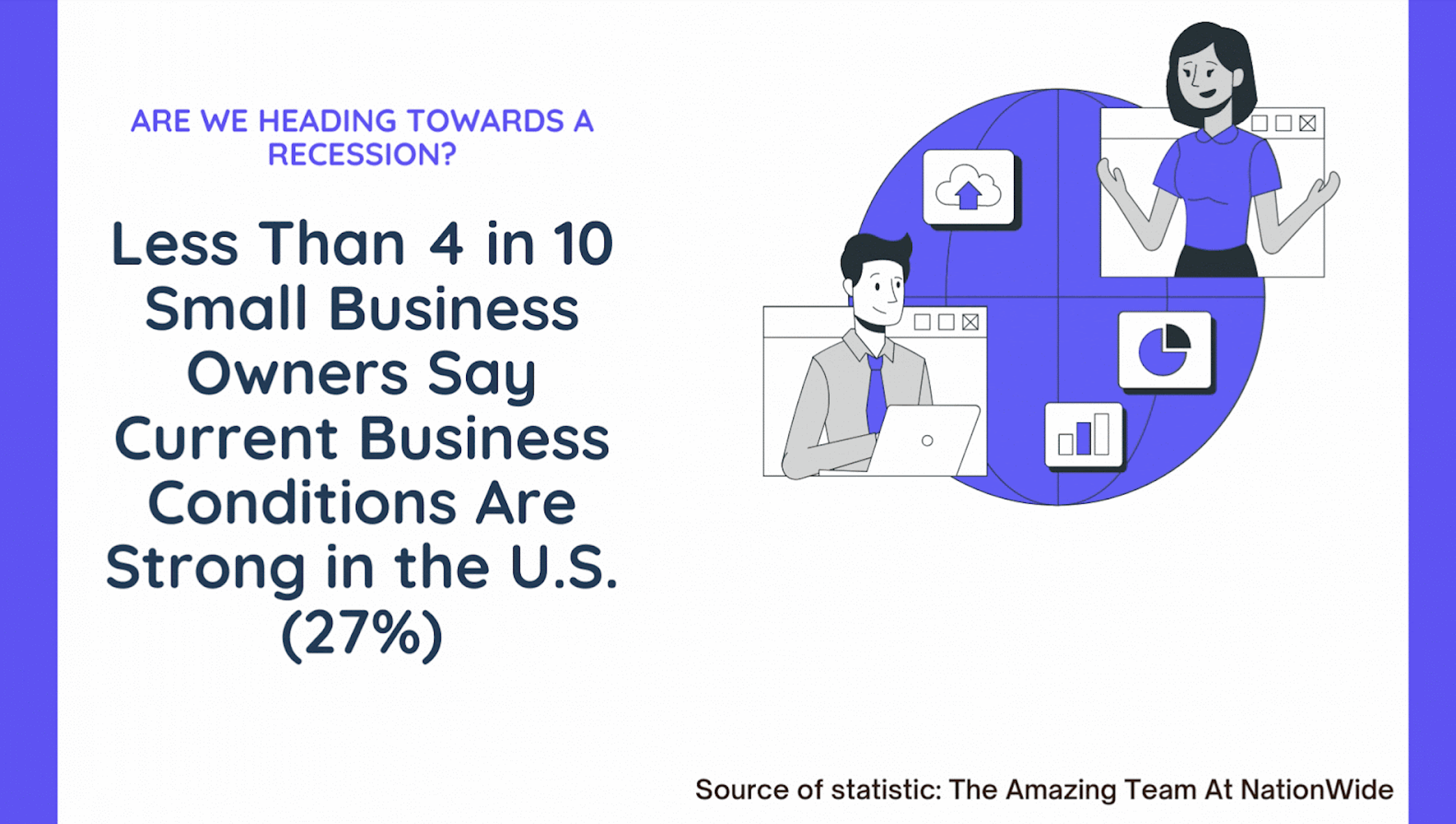

We are currently living in times of uncertainty. Experts predict with a probability of 23.07% that by September 2023, the United States will fall into another economic recession.

It is undoubtedly a scary time, especially if you are a small business owner whose livelihood depends on the income you receive from your business.

Unsurprisingly, less than 4 in 10 small business owners say current business conditions are strong in the U.S. (27%) or in their own region or city (36%). Additionally, 70% of small business owners expect a recession in the U.S. within the next 6 months.

Over 99% of America’s 28.7 million firms are small businesses. Beyond that, 88% of employer firms have fewer than 20 employees, and nearly 40% of all companies have under $100k in revenue.

Sadly, almost 4 in 10 say their business revenue has decreased over the past six months, with most declines being as high as 30%. Even with this outstanding data, only 37% of small business owners say that their company is prepared to weather a recession.

After reading this, you might be concerned about your small business and how you will survive an upcoming recession. Rest assured, however, that there are some easy-to-implement adjustments that you may put into action today to keep your company safe.

In this article, we will look into simple ways to keep your small business financially secure in a downturn and beat the ominous odds.

Decrease Spending

As a business owner, you always want a steady influx of revenue. To achieve that, however, you cannot just be worried about sales. Instead, you must look at your expenses and understand where your cash is going.

You’ve probably already experienced prices creeping up gradually, if not drastically. However, 6 in 10 small business owners say inflation has already negatively impacted them, so according to the odds, you have probably already felt this increase.

Small businesses with no employees have an average annual revenue of $46,978, and the average small business owner makes $71,813 a year. Therefore, as a business owner, you must start taking steps to protect your revenue and income.

Begin by taking an in-depth look at your expenses. First, decipher where all your cash flow is going. Then, categorize every small portion of your budget so you have a clear picture of what is being spent and how you may cut costs to decrease your spending.

Consolidate Expenditures

As you are looking into ways to cut expenses, consider whether there are any expenses you can combine. An easy example is multiple subscriptions, as many applications are all-inclusive and offer several features all in place.

Volusion, for example, offers everything you need to start and host your ecommerce website. From managing customer accounts and returns to creating purchase orders and managing inventory, you will not need a multitude of additional subscriptions to keep your ecommerce business running.

Shockingly, 80% of small businesses are not fully utilizing available technology. Do not let yourself be a part of this statistic—ensure you use technology to its fullest capacity. Technology is an excellent way to maximize your potential, so invest wisely, and you will see optimal results.

Cut All Unnecessary Expenses

Over one-third (32.8%) of small business respondents identified “lack of capital” as the #1 reason the business had to close. Don’t fall prey to this statistic by not having cash on hand. Be proactive and take a good look at your current expenses. Are there any that you can cut? Do you have unnecessary plans, subscriptions, or supplies you don’t need? Cancel them right away and start improving your capital.

If you need to, look at your employees. Are they all being used to their potential? If not, is there something they could be cross-trained in to make them even more valuable to your business? If it does not seem worth training them more, consider whether you still need a dedicated employee for that task.

If you do reach the point of a reduction in workforce to reduce expenses, make sure you are keeping your A Players. Even if they require some training, it is worth holding on to the best employees as long as you can to save money by not having to completely retrain when it comes time to hire again.

Now is also the time to consider if there are any tasks you can start doing yourself. For example, if you hire an office cleaning service, but your current employees have nothing to do, they would probably be fine with taking that responsibility while sales are low. On the other hand, if an employee is tech-savvy, they could improve your website and your SEO to attract new customers.

Another way to cut down expenses is to pay down your debt. 40% of small enterprises have debts of $100,000 or more, and interest rates accrue quickly. Work your hardest to pay down your debt so you may be free from such a significant financial burden in uncertain times.

Build Up Cash Reserves

Only run your business partially on your cash flow. Make sure that you are buffering your cash reserves during these uncertain times. A good practice is automating deposits into savings accounts so you know that you regularly set additional money aside.

Sadly, the median small business only holds 27 cash buffer days in reserve and an average daily cash balance of $12,100, with wide variation across and within industries.

Find ways to save up extra cash—from additional savings every month to improving dividends on your stock, there are several ways you can quickly and easily build up your reserves.

Never Cut Legal Expenses

As tempting as it may seem, never save money by cutting legal expenses. 36-53% of small businesses are sued annually, and almost 90% of all businesses are engaged in litigation at some point. Be sure to keep your company safe by always having legal counsel.

You never know when something as unfortunate as being sued may occur, but having the right lawyer will ensure that your company is covered and safe.

Diversify Your Client Base

You never want to put too many eggs into one basket, so help keep your business financially secure by diversifying your client base.

If any single customer accounts for 10% or more of your revenue, or if your largest five customers account for 25% or more of revenue, you have a high customer concentration. High customer concentration should be avoided, as it is a significant risk factor. For example, if a customer makes up 30% of your revenue and they decide, for whatever reason, to no longer do business with you, you have suddenly lost 30% of your revenue.

To increase and diversify your client base, you should:

- Develop strategic partnerships and network

- Expand your cultural and demographic reach

- Convert online inquiries into an actual sale

- Use a Customer Relations Management program to manage your leads

- Create a referral program

Expanding your reach and going after new customers is an excellent, proactive approach to staying ahead during changing times.

Have an Open Mind

Instead of sticking to the way things have always been done, use this time as an opportunity to make changes and reach great lengths you have never reached before.

Do not let your small business be run out by competitors or lack of cash flow. Studies show that 79.7% of people need to adapt their business every two to five years. Be innovative and stand out from the crowd to make sure your customers know how unique your small business is.

Image Source

Consider Going Completely Virtual

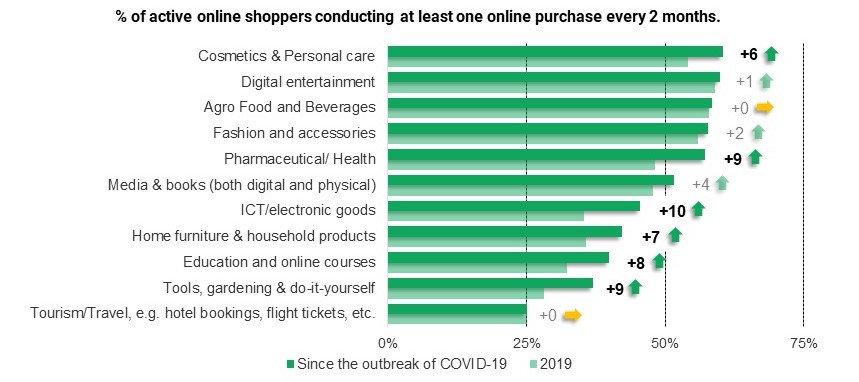

Whether we like it or not, the pandemic has entirely changed how people do business. Gone are the days when an individual must drive to a store to find their product or go to a set location to take care of business.

Unsurprisingly, a study from Digital found that 69% of businesses in the U.S. have permanently closed some or all of their office spaces since March 2020, and 37% have permanently closed all office spaces.

With data like this, it’s almost impossible not to consider why you still have an office space open. There are several factors that you should consider when deciding whether or not to keep a physical location, such as how many customers come into your place of business to the ability of your workforce to be remote.

By 2023, worldwide retail ecommerce sales are projected to total $6.169 trillion and make up a 22.3% share of total retail sales. If your business is something you can turn into a complete ecommerce business, study best practices for running a successful ecommerce website and take the plunge to start saving money and increasing your cash reserves.

Focus on Being the Best

In whatever your field, focus on being the best at what you do. If you are still determining what you do that is considered best, create a study to learn what leads to success. Analyze your competitors to see what they are doing to stand out, and analyze successful companies to see what they’ve done to remain successful in changing times.

Once you have learned from others, consider your own company to decide where you will focus your efforts to be the best at what you do. Good to Great author Jim Collins said it best: “You can be passionate all you want, but if you can’t be the best at it or it doesn’t make economic sense, then you might have a lot of fun, but you won’t produce great results.”

Final Thoughts

Change is scary, but trying to keep up with the unknown is even more frightening. In this time of unknowns, you must take proactive steps to keep your small business financially secure, no matter what does or does not end up coming your way.

Thankfully, individuals have come to appreciate and celebrate small businesses. Consumers will choose small businesses when convenient 91% of the time, and 74% look for ways to support small businesses even if it’s not convenient. 53% of people even say shopping at small businesses gives back to their communities and gives them more purpose in their shopping habits.

Know that your community is there to support you through difficult times. Plan ahead, save money, and stay ahead of any unfortunate occurrences. This will ensure that you keep your small business safe during rough times.