Starting a new business is an exciting and invigorating time where entrepreneurs feel empowered by the seemingly endless possibilities of success. During this initial time period, however, new business owners may be oblivious to the importance of having good accounting practices in place from the very start.

Developing a business budget, tracking expenditures, and having innovative ideas are all important aspects of starting a business. However, it is essential for new business owners to be aware of best accounting practices. Without knowledge of how to effectively run the financials of a company, there is a great risk of failure.

Starting any new business can be tricky, but knowing what not to do is a great way to start off on the right foot. Below, we cover 10 common accounting mistakes that new business owners make—and what you can do to avoid them.

1. Not Starting off with a Business License

One common mistake many new business owners make is not having a business license when the business first opens. You might believe that this is not necessary at the outset, but starting a business off legally is the correct way to do things (and will help avoid future trouble). Don’t feel intimidated by this step, as it is actually very easy. The majority of the process may be done online through each state’s Department of Revenue website.

This does not only apply to physical businesses, but also to online businesses. Registering a business benefits you for a couple of reasons—it gives you credibility (especially when your business is online), helps you establish an identity online, and also minimizes your personal liability.

2. Mixing Personal and Business Expenditures

The saying that business and pleasure should not be mixed holds true in this case. It might seem harmless to run your business card on a night out on the town or include a few personal things when shopping for the business, but doing so will make tracking the ins and outs of the business’s financials more difficult.

Make sure to only use business bank accounts and bank cards for business expenditures. These accounts should be opened before the first goods are sold or service is provided to ensure that revenues and expenses are tracked correctly from the very start. Doing this will keep monthly and yearly tracking much easier.

On the flipside, you should also avoid using your personal card for business expenditures (even if it is more readily available in the moment) to reduce confusion later.

3. Failing to Hire Outside Help

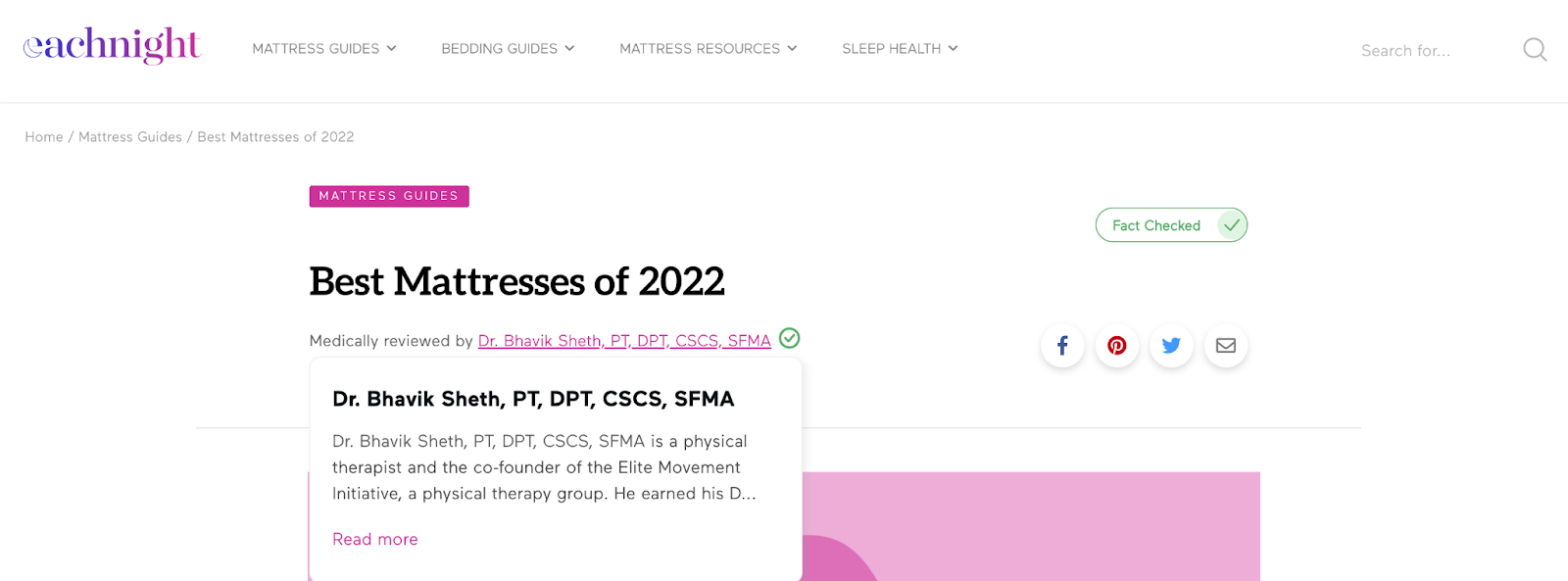

Many new business owners start off feeling like they could conquer the world. That feeling is incredible and certainly can help save some money, but you may soon realize that you have too much on your plate and admit that you need some help. This could mean taking on help managing your blog, bringing on an expert for advice, or hiring a design company to speed up or redesign your website.

This is not only limited to ecommerce or SaaS businesses. Even blogs that have reached some level of success inevitably need to bring on help to take things up a notch and continue on that awesome growth trajectory. For example, Eachnight brought on a medical expert to review their listicle on best mattresses:

While this might “eat into profits” at first glance, the money is made up for by the fact that having a medically-reviewed article makes the business more trustworthy in the eyes of readers and search engines.

4. Not Keeping an Emergency Fund

Investing everything you have and not keeping a nest egg is always a bad idea. Your light bill could come back unusually high one month, or materials could increase in price unexpectedly. Regardless of the case, you must always have an emergency plan for surprise expenses. Simply deciding to put all unexpected expenses on a credit card is a terrible idea—interest rates are on average anywhere from 20-30%, and it could be very difficult to pay the debt back quickly.

A good plan is to always stash away a percentage of your profits as an emergency fund. You can also use other creative methods to save additional cash. That way, when something comes up unexpectedly, there is no need to panic as you will already have reserves in place.

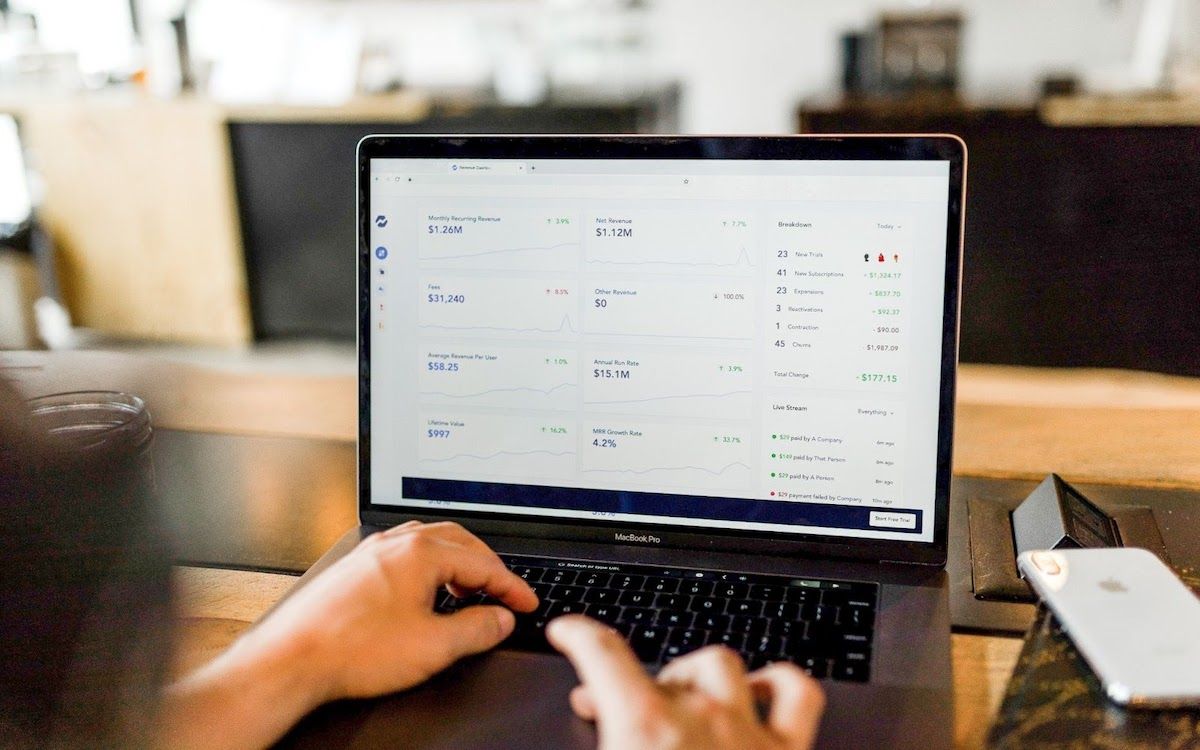

5. Focusing on Sales Instead of Profit

Watching money come into your bank account is very satisfying; however, if you are only tracking the sales and not the profits, you will be extremely surprised when you close out the month.

Sales are actually very different from profit, which subtracts the funds required to make the sale from the equation. A good business owner is aware of how much profit they are making on each item. Simply deciding a price without calculating the profit margin is a dangerous venture for any business.

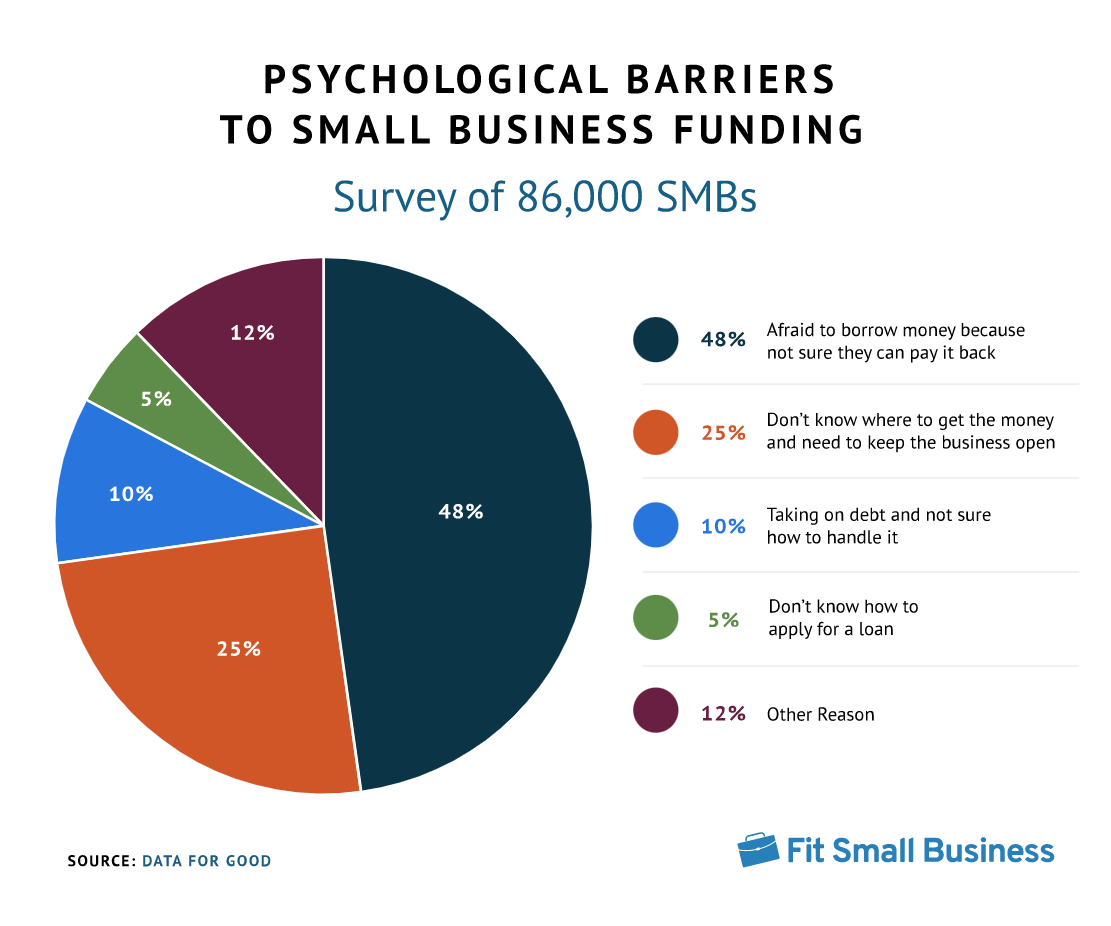

Image Source: Fit Small Business

6. Failure to Save Receipts

A good business owner understands how important keeping track of all expenditures is for accounting purposes. While keeping receipts can be quite a pain, it is an important step in tracking expenditures. The idea of having to remember to ask for receipts and keeping up with them can feel frustrating. Thankfully, the IRS does not require that receipts be in paper form, so all receipts may be digitized.

When saving receipts, “the more the merrier” seems to be the best policy. It would be better to save extra receipts that were not needed than to start filing your taxes and realize that some important receipts are missing.

According to the IRS, some key receipts that should always be kept are:

- Gross receipts: the income received from a business.

- Cash register tapes

- Deposit information (cash and credit sales)

- Receipt books

- Invoices

- Purchases: items that are bought to sell to customers.

- Canceled checks or other documents showing proof of payment/electronic funds transfer

- Cash register tape receipts

- Credit card receipts and statements

- Invoices

- Expenses: costs that are needed to keep the business running.

- Canceled checks or other documents showing proof of payment/electronic funds transferred

- Cash register tape receipts

- Account statements

- Web Hosting

- Internet and phone bills

- Credit card receipts and statements

- Invoices

- Travel, Transportation, Entertainment, and Gift Expenses

- Assets such as furniture or machinery that were purchased for the business

Digitizing receipts and saving them in monthly folders on your computer is an easy way to keep up with them. If saving actual paper receipts and cash register tape receipts is the preferred method, then a good filing system where receipts are filed by month and within each month by category is the best bet. This will make month-end and year-end closeouts much easier to manage.

7. Inadequate Financial Planning

Not knowing what the end goal is could be a huge deal. Many small businesses start with a small cash flow and grow with time. However, if you wish to start with a higher cash flow, you could try applying for a grant (ex: a minority grant, if applicable) to ensure that you have a higher cash flow—and possibly even assistance with the financial planning of your new business.

Knowing how much money is coming into and out of the business is essential to success. You should not just assume that you are selling enough, so the financials must be fine. In truth, you need to evaluate your financials on a daily, weekly or, at the very least, monthly basis to understand how the business is doing. Creating financial plans and setting goals will allow you to stay on track with your end financial goal.

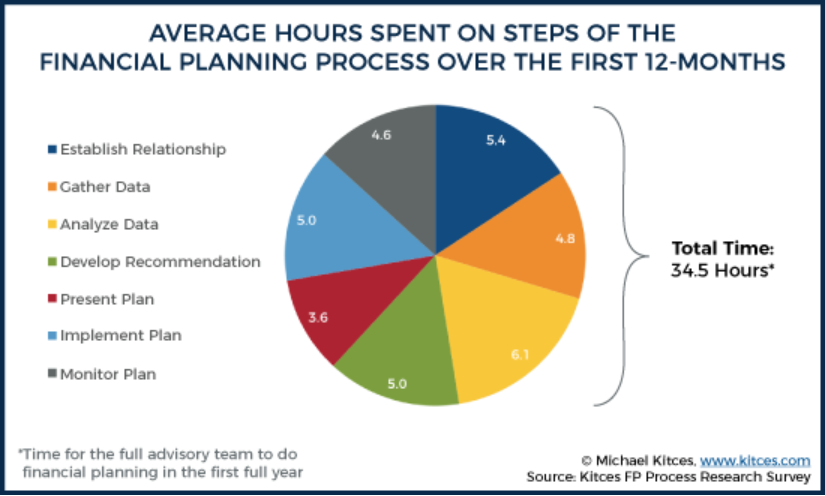

Image Source: Kitces

8. Not Having a Business Plan

Part of good financial planning is having a business plan. If you are unsure how to make one, there are great online resources available to help you prepare one. Starting a business off with a business proposal will let you establish a key path on how to structure, run, and grow the business while staying on track for financial goals.

9. Mathematical Errors

Manual entries are always prone to error, and mathematical errors due to manual entry can be disastrous. It is always important to double-check calculations and data entry to ensure that all of the information is accurate. A transposed number or a wrong formula can be a huge deal in small business accounting.

Rushing accounting is never advisable. Sometimes it is best to process everything in one day, but wait a few hours or go back the next morning and double-check the work. A few hours away can make a world of difference and help you catch any errors that were made in a rush.

10. Not Managing Billing Properly

Not keeping up with invoicing or billing, and not knowing when and how to charge sales tax, can quickly become a very serious problem. Late fees, interest, and penalties can quickly add up, taking away from your overall revenue. Knowing how to do this efficiently will ensure that there is a good cash flow so you can use the revenue to pay for expenses and other needs.

In this case, auto-paying for certain expenses can be a very good thing. Utilities, rent, subscriptions, and other business expenses can be put on automatic payments so that you do not need to remember to go back and pay these things every month. Simply ensure that these expenses are going on the business credit card or other business accounts to stay organized.

How to be a Successful Small Business Owner

The rules above provide great guidelines on what not to do with a new business. If new business owners avoid the mistakes above, they are already one step ahead of everyone else in ensuring that their business is successful. Good planning and avoiding common accounting mistakes will only improve the chances of the business being successful.