Give Your Sales a Boost with PayPal’s Pay Later Integration

Add PayPal Pay Later to your payments strategy to offer a variety of payment methods in addition to debit and credit cards.

ACTIVATE NOW

PayPal is one of the world’s most preferred, trusted, and familiar brands1

81% of the fastest-growing companies respondents accept PayPal for online purchases.2 In fact, 49% of users say they've abandoned a purchase because PayPal wasn't an option.3

20+

years of experience

200+

markets around the globe

100+

different currencies

Pay Later is good for business

Help increase sales

Give customers more spending power and help boost your average order values.

#1 trusted brand

Rated most trusted brand across buy now, pay later providers5

Get paid up front

And let customers spread their payments over time.

No additional costs

Pay Later is already included with your PayPal Checkout at no additional cost.

Attract NextGen customers

Millennials and Generation Z consumers plan to use BNPL more than other age groups.4

Easy promotion

Add dynamic Pay Later messaging to your site with a single integration.

Offer customers more ways to buy

Once enabled, Pay in 4 and Pay Monthly6 dynamic messaging can help increase your conversions,7 boost average order values (AOV),8 and encourage customers to buy more9—and buy again.10 It’s easy to activate in just a few clicks.

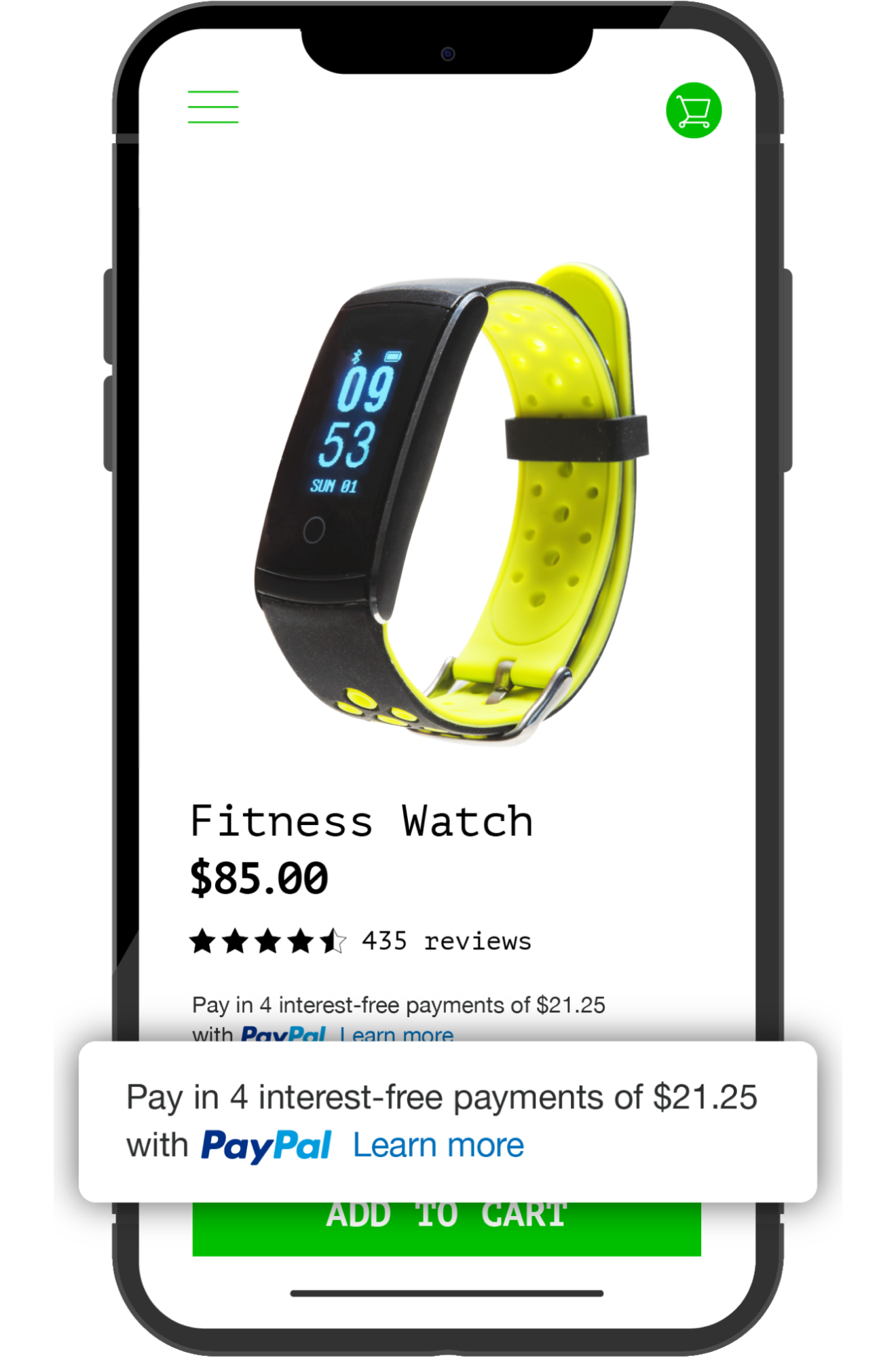

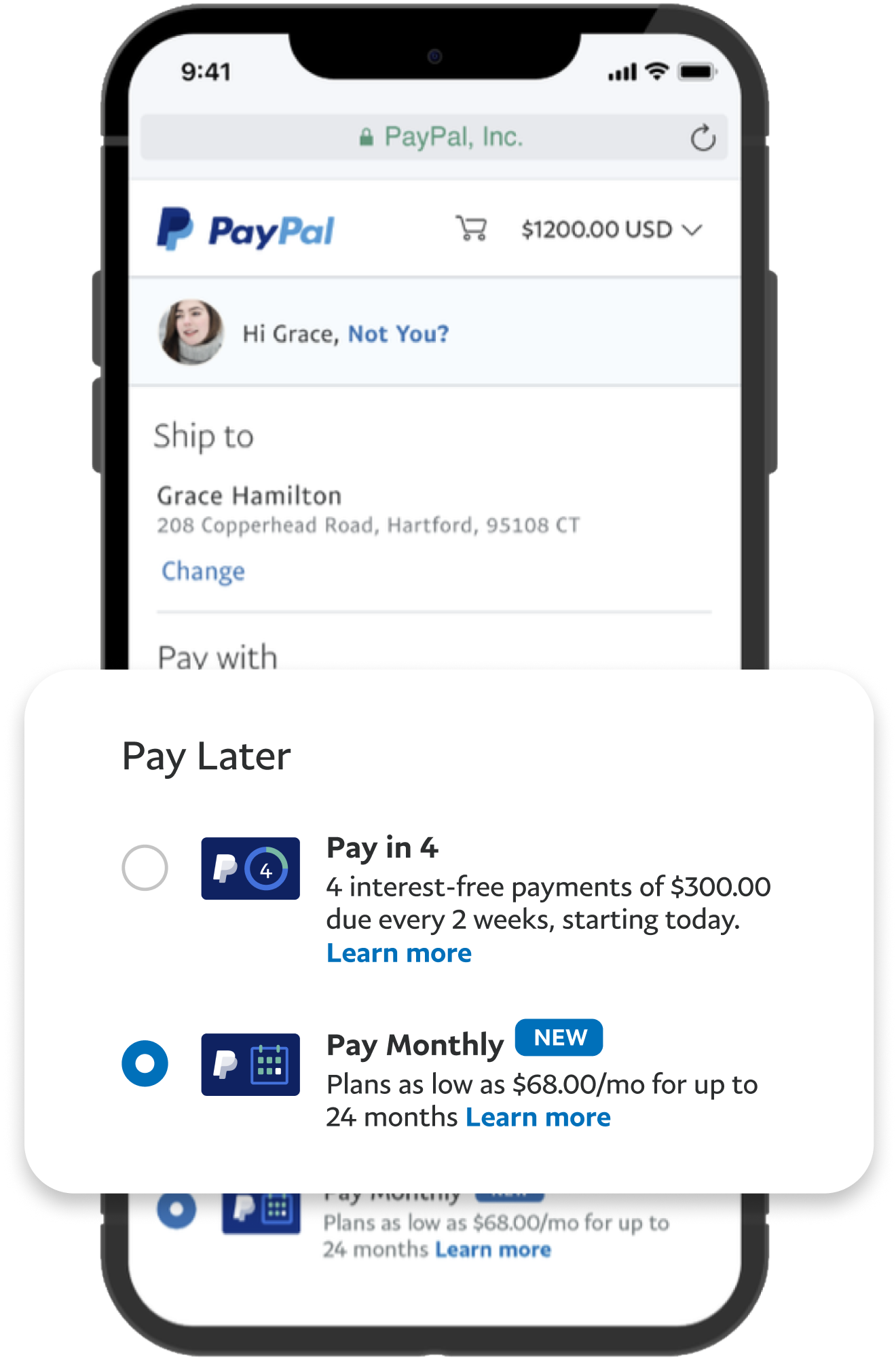

Pay in 4:

4 interest-free payments over 6 weeks on purchases up to $1,500.

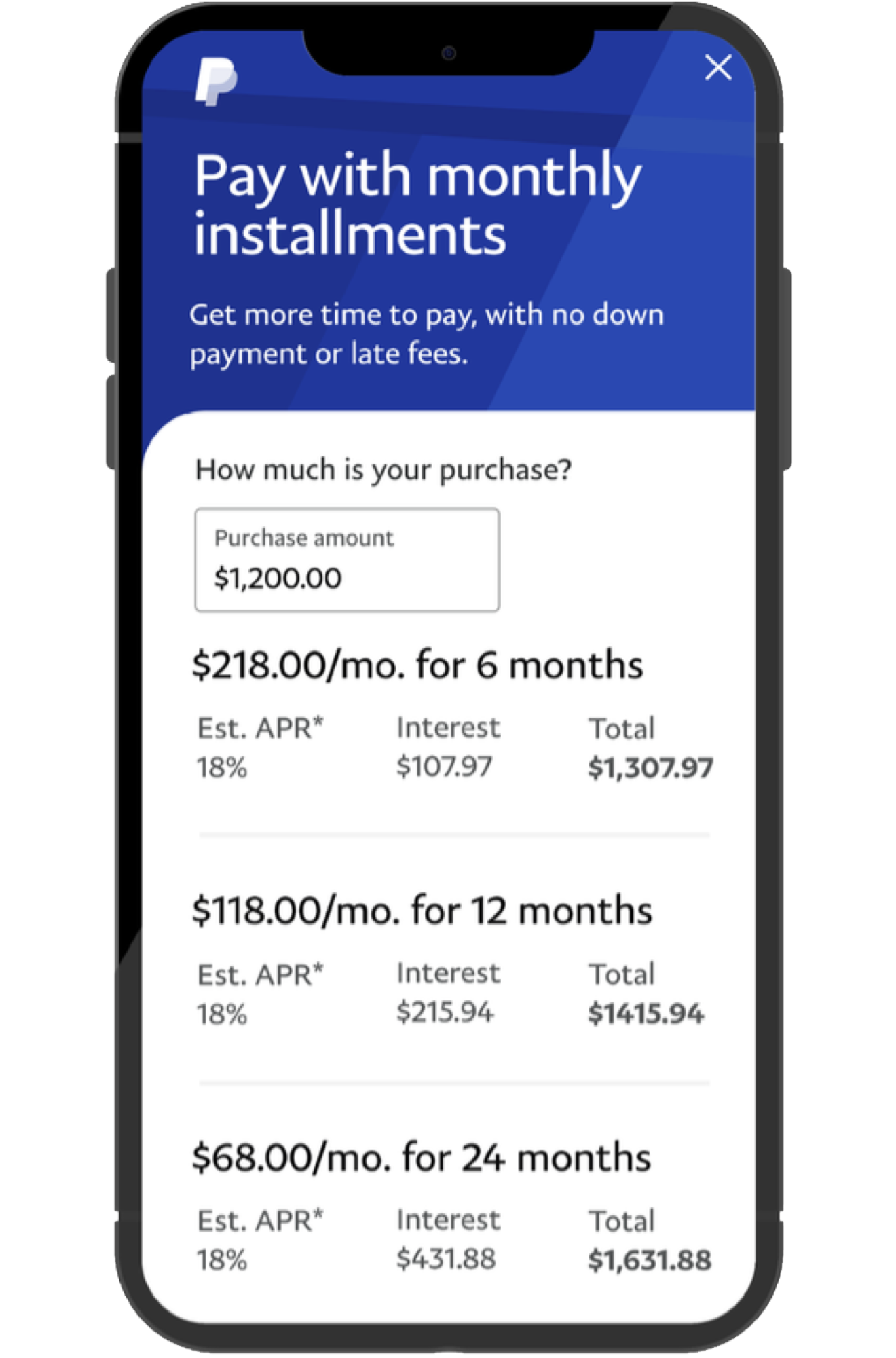

Pay Monthly:

6, 12, or 24 monthly installments on purchases up to $10,000.

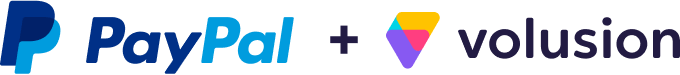

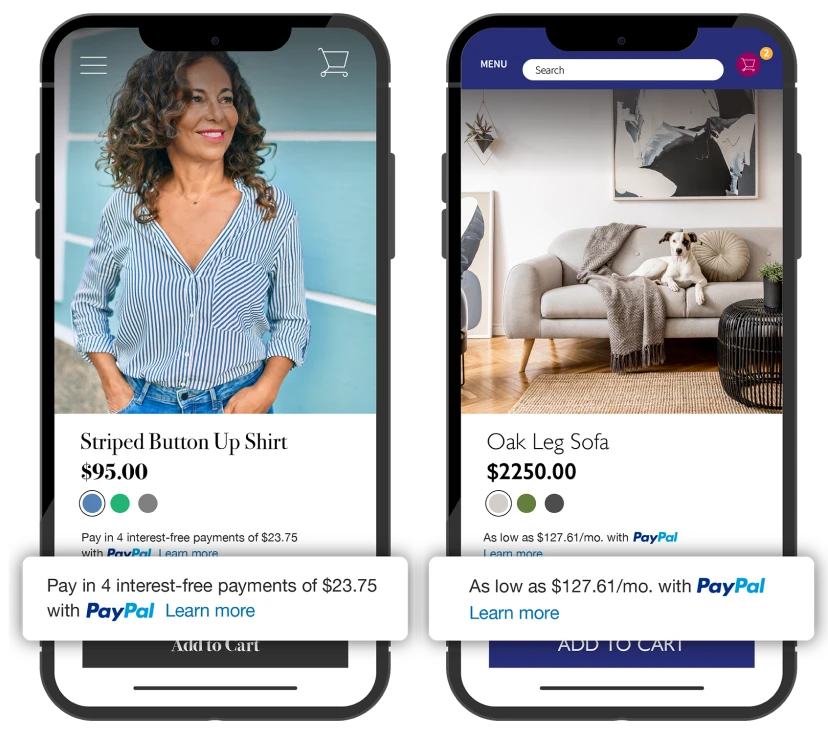

What customers will see

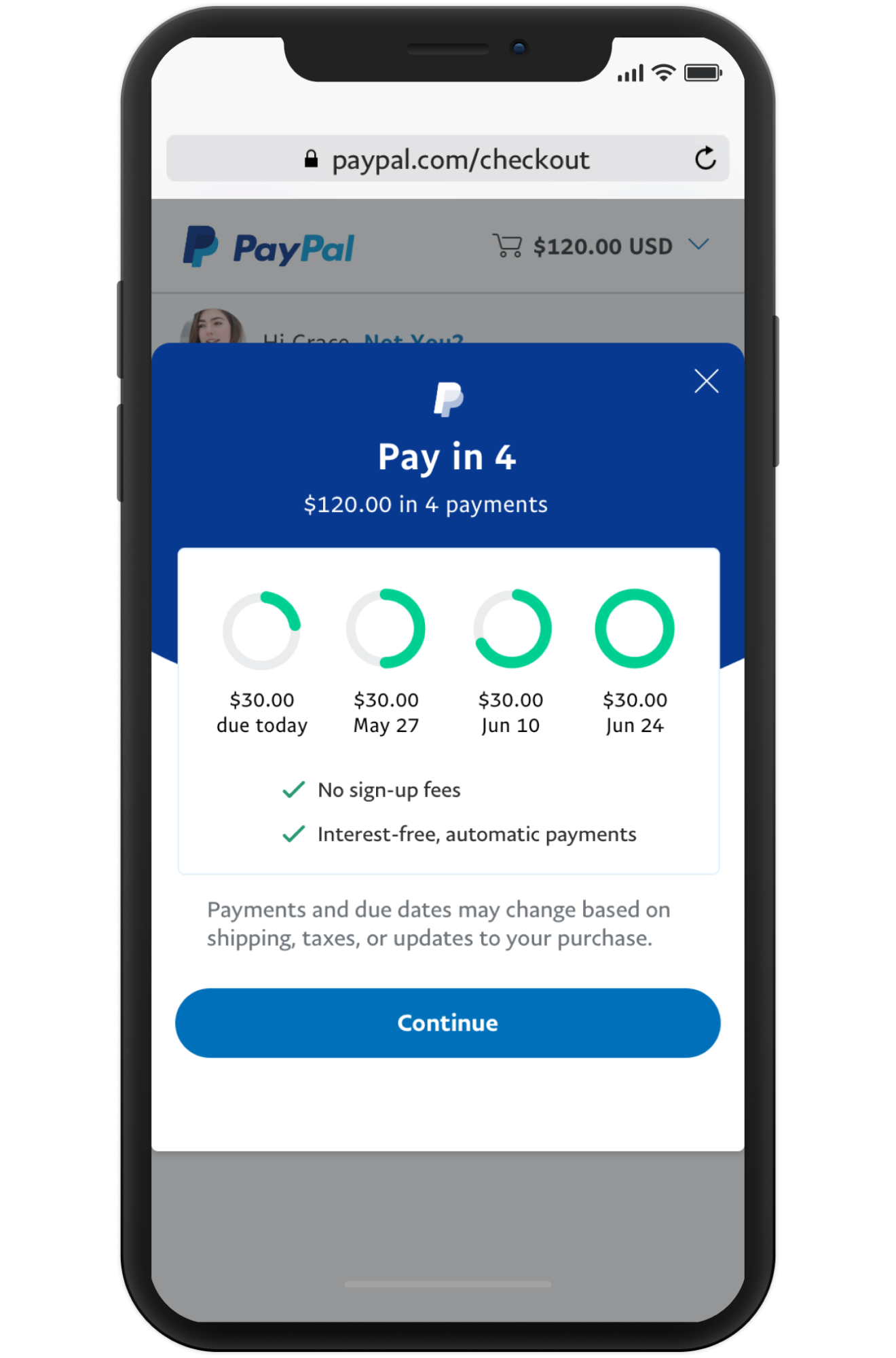

Pay in 4

Pay Monthly

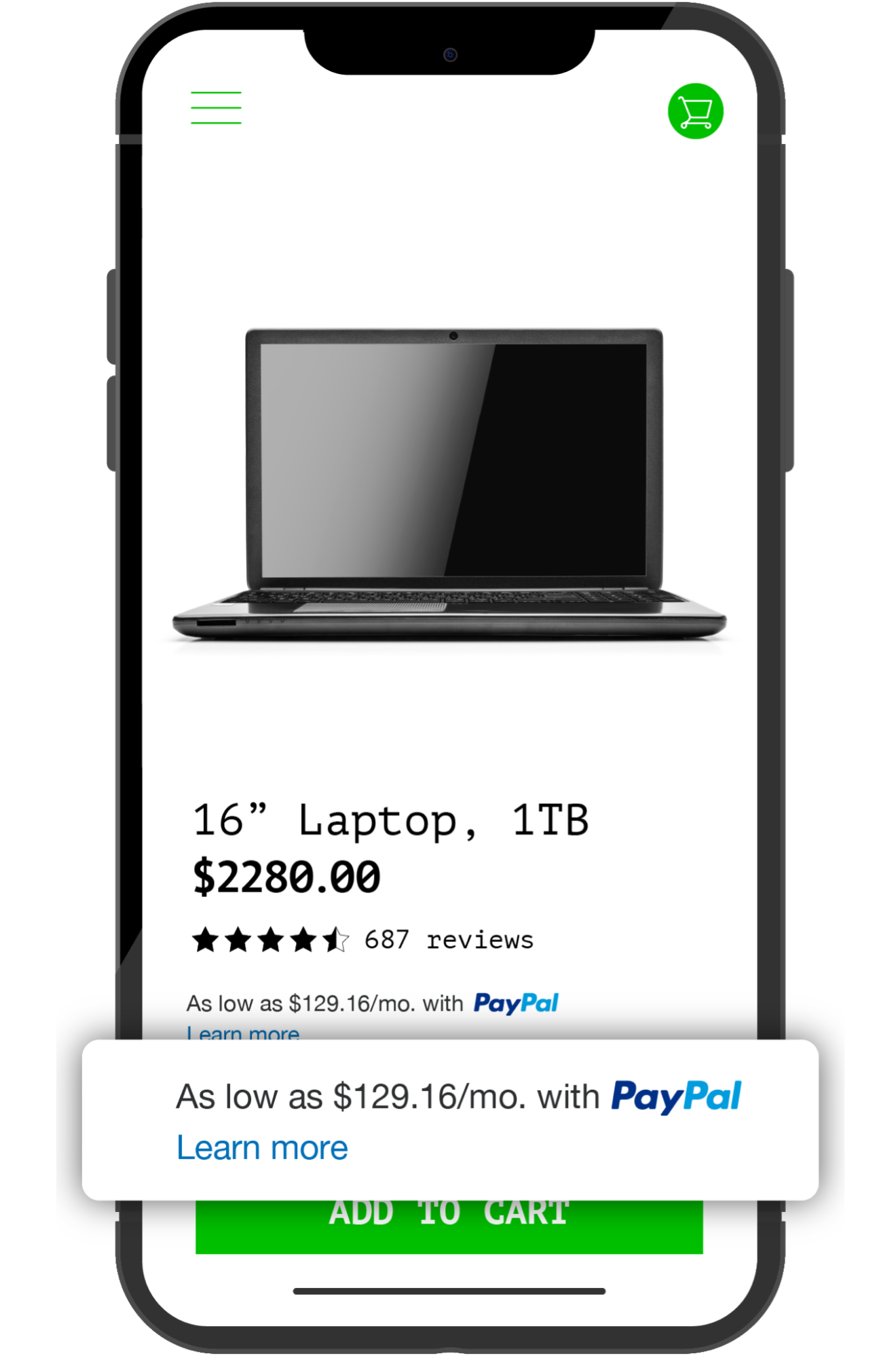

Show dynamic Pay Later messaging on your site

Once enabled, dynamic messaging will display the most relevant Pay Later offer—either Pay in 4 or Pay Monthly—to your customers while they’re shopping.

Your customer sees the most relevant Pay Later option.

Customers choose between Pay in 4 or Pay Monthly at checkout.

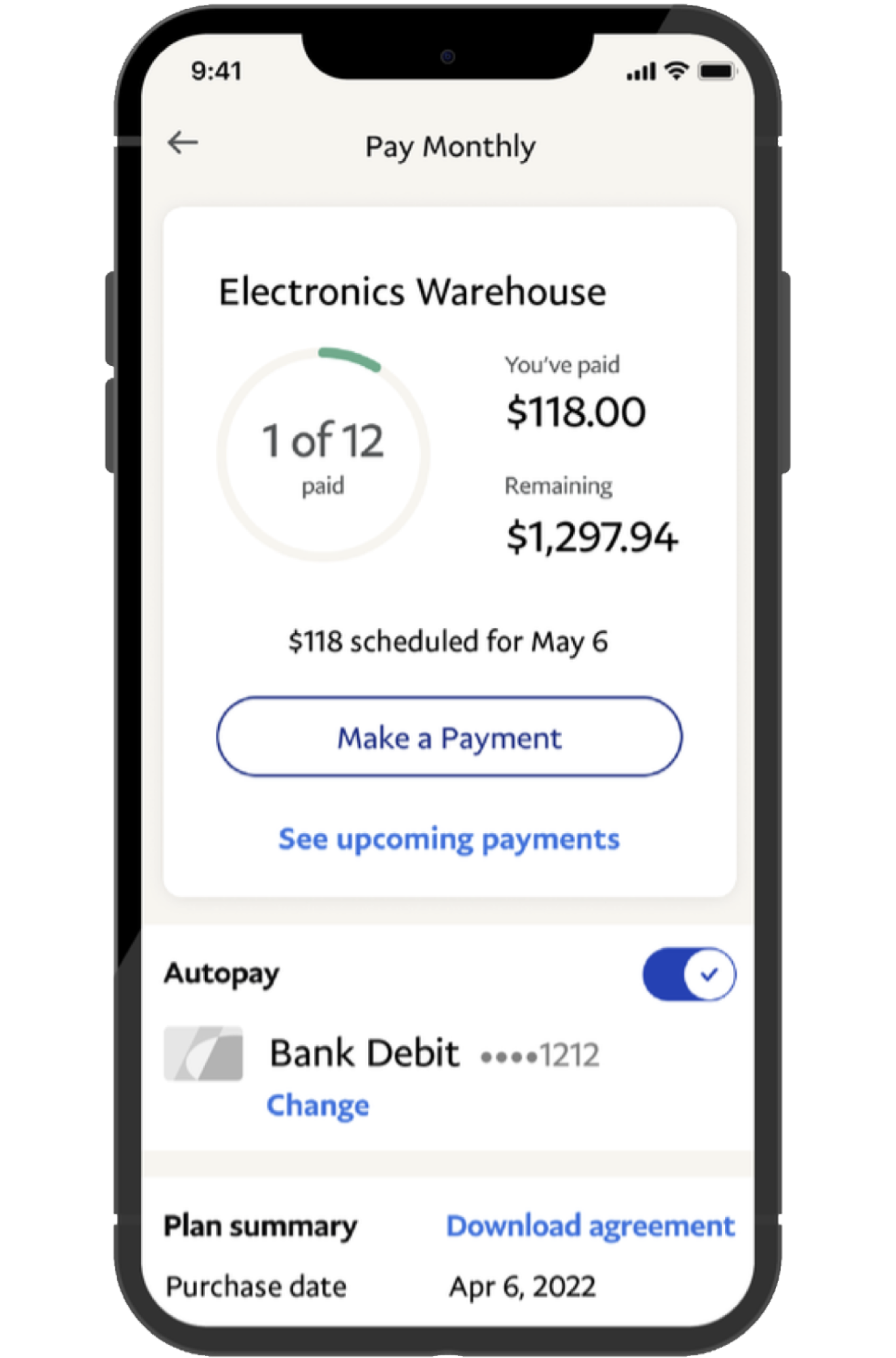

Customers get clear payment information

Pay in 4 or Pay Monthly payments are clearly presented.

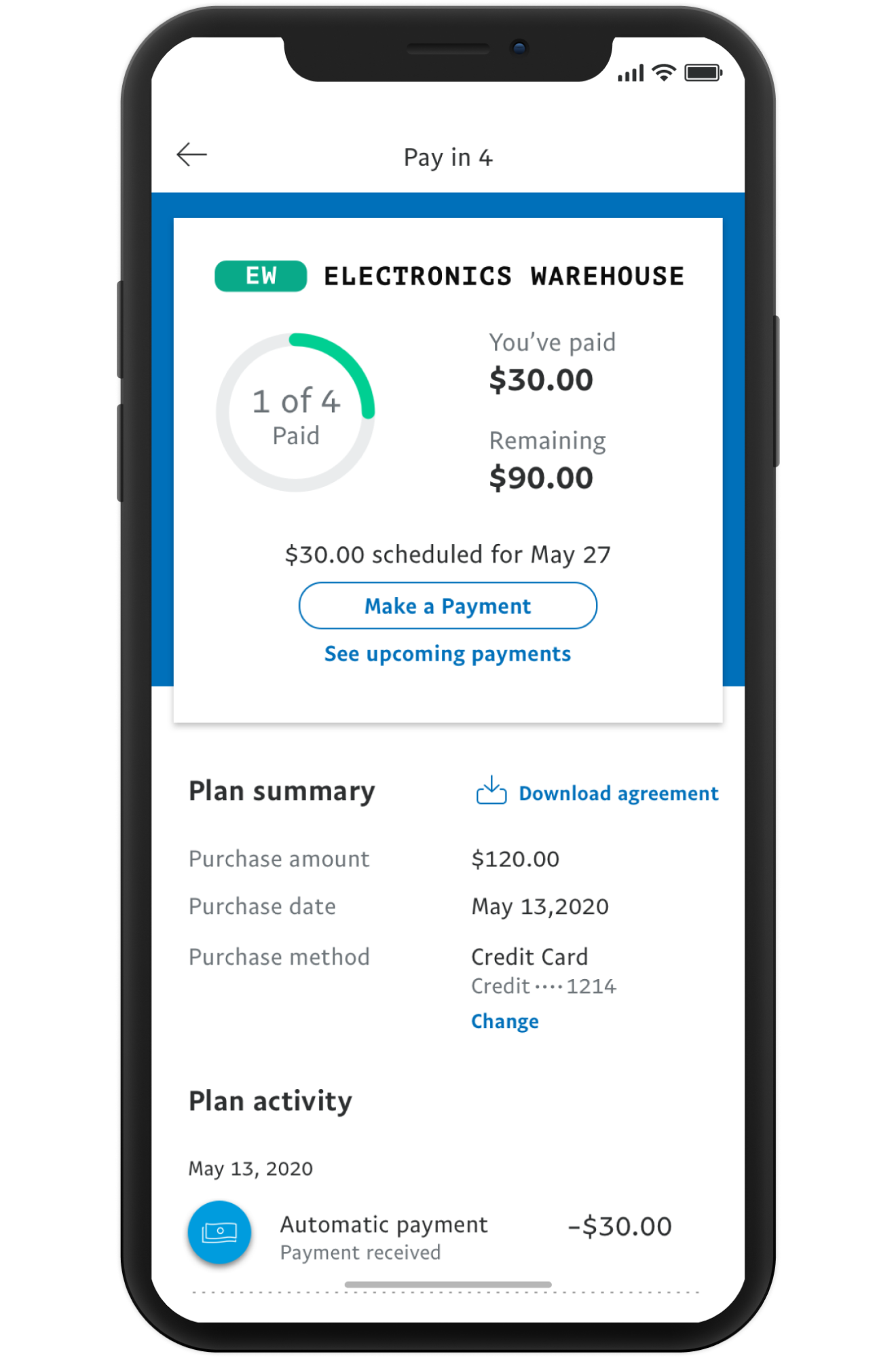

PayPal does the rest

Once the order is processed, you get paid up front. And PayPal takes care of collecting payments from your customers.

What Pay Later means for your bottom line

63%

more likely to purchase

Almost two-thirds of buy now, pay later (BNPL) users say they are more likely to complete a purchase if a BNPL option is available.11

39%

increase in cart sizes

PayPal Pay Later is boosting merchant’s conversion rates and increasing cart sizes by 39%.12

84%

look for it before checkout

The majority of buy now, pay later (BNPL) users decide to use a BNPL solution prior to checkout.13

Activate PayPal Checkout on your Volusion store

See this page for PayPal’s most up-to-date fee structure, and activate the latest PayPal features by following the simple steps in our Help Center.

1Morning Consult - The 15 Most Trusted Brands Globally. March 2021. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current state of consumer trust across brands.

2IDC. An IDC Thought Leadership White Paper, Commissioned by PayPal. June 2021. IDC partnered with PayPal to study how ecommerce-enabled enterprises in the US are adapting to today’s digital economy and which business-level objectives are driving technology investments.

3An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39 (among PayPal users, n=682).

4The Truth About BNPL And Store Cards Report, an online study commissioned by PayPal and conducted by PYMNTS, based on a census- balanced survey of 2,161 U.S. consumers from Dec. 10 to Dec. 17, 2021.

5PayPal is the most trusted brand across BNPL payment providers. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

6About Pay in 4: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. PayPal, Inc. is a GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee. Pay Monthly is subject to consumer credit approval. Term lengths and fixed APR of 9.99-35.99% vary based on the customer's creditworthiness. The lender for Pay Monthly is WebBank. PayPal, Inc. (NMLS #910457): RI Loan Broker Licensee. VT Loan Solicitation Licensee.

Pay Monthly is subject to consumer credit approval. 9.99-29.99% APR based on the customer’s creditworthiness. PayPal, Inc.: RI Loan Broker Licensee. The lender for Pay Monthly is WebBank.

762% of BNPL users say that seeing a buy now, pay later message while shopping encouraged them to complete a purchase. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

8PayPal’s Buy Now, Pay Later is boosting merchant s conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

980% of BNPL users agree that seeing a BNPL message while browsing gives them the ability to spend more. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357).

1074% of BNPL users are more likely to shop at a merchant again if they offer a buy now, pay later option. TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).

11TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255).

12PayPal’s Buy Now, Pay Later is boosting merchant s conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

1384% of BNPL users decide to use a buy now pay later solution prior to checkout. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL users, n=357).